Mobile Payment Options Drive Better Mobile Experiences

Did you know that more than 30% e-commerce sales are made from a mobile device or smartphone? As this number continues to rise, mobile is quickly becoming the channel of choice for digital shoppers.

Retailers that have built their digital experiences from a mobile-first perspective are already ahead of the trend. These brands go well beyond just responsive design to create engaging shopping experiences for notoriously fickle mobile users.

Mobile commerce has long been famous for driving traffic but lacking conversion. According to VentureBurn, “The average shopping cart abandonment rate falls around 68%, but for mobile it is a distressing 97%. Meaning, out of 100 filled carts, only three will turn into sales.”

With so many shoppers turning to their mobile devices to access the internet, eliminating abandonment and driving healthier conversion needs to be of utmost importance to retailers.

Why Are Mobile Carts Abandoned?

Here are the top reasons why mobile shoppers abandon carts:

- Long Checkout Processes

- Required Registration Forms or Checkout Login

- Limited Payment Methods

- Poor Checkout Experience

As you can see, cart abandonment comes down to checkout flow. Shoppers have a strong dislike for filling out lengthy forms and repeatedly entering information. This problem is exacerbated by mobile screen and page size limitations. Digital commerce – especially mobile commerce – is all about convenience and lengthy checkout flows are an inconvenient part of any shopper’s journey.

How Do You Improve?

Improving checkout flows and mobile design is a time-intensive process. The lowest hanging fruit here, though, lies in mobile payments.

In the US, there are more than 230 million smartphones in use. According to Juniper Research, 16.5% of these devices bought $47.6 billion in physical goods in 2016, and these numbers have only grown to today. In the UK, a whopping 74% of the population uses their mobile device to make payments.

According to HIS Markit, over 3.4 billion smartphones are equipped with mobile payment applications. By 2021, that number will have climbed to 5.3 billion. Mobile payment support will only become more critical for retailers moving forward.

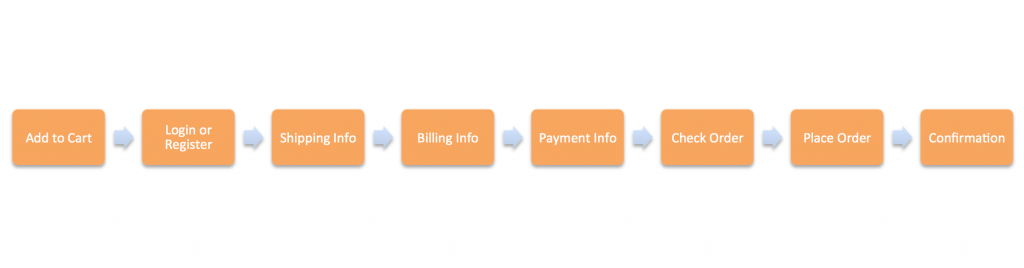

Here is a typical checkout process:

With mobile payment technology, here is what the process can look like:

As you see, this is a much shorter and simpler process.

What is “Mobile Payment?”

Mobile payment is a big term that can mean many things, from paying at the grocery store with your smartphone to swiping your card on your friend’s tablet, to transferring money to coworkers through your smartphone. For mobile commerce, we’ll look at mobile wallets – popular platforms that enable consumers to easily enter information and complete their orders – Apple Pay, Android Pay (now called Google Pay), and PayPal.

1. Apple Pay

Apple Pay lets users make one-tap purchases within apps that have adopted the Apple Pay API, and it is available on the web with iOS 10 and macOS Sierra. Compatible devices feature Touch ID and contain an NFC controller where the “Secure Element” of Apple Pay is located, keeping customer information private.

Apple Pay is growing in popularity: in October of 2016, Apple CEO Tim Cook said Apple Pay transactions are up over 500 percent, and in September of 2016, Apple saw more Apple Pay transactions than across all of fiscal 2015. These numbers continue to grow well into today.

2. Google Pay (same as Android Pay)

Launching last week, Google Pay is the replacement for Android Pay. Smart tap technology remains an option at checkout for consumers using Android phones at NFC-enabled terminals. This will keep sensitive payment details safe while making it simpler for website users to complete orders. It will be interesting to see how Google Pay will compete with, and differentiate itself from, Apple Pay and PayPal in the coming months and years.

3. PayPal Express Checkout

PayPal Express Checkout gives buyers a simplified checkout experience that keeps local to a website or mobile app throughout the payment authorization process and lets them use their PayPal balance, bank account, or credit card to pay without sharing or entering any sensitive information on the commerce site.

With more than 200 million current users, availability in more than 200 countries, and support of 25 currencies, PayPal is the most widely used mobile payment option in the world.

As you can see, retailers have options when it comes to mobile payment technology, and consumers are willing to use it to conduct mobile commerce more efficiently. With more people than ever shopping through mobile devices, retailers need to optimize their mobile experiences today if they want to see digital success in the near future.